This article was originally published on June 10.

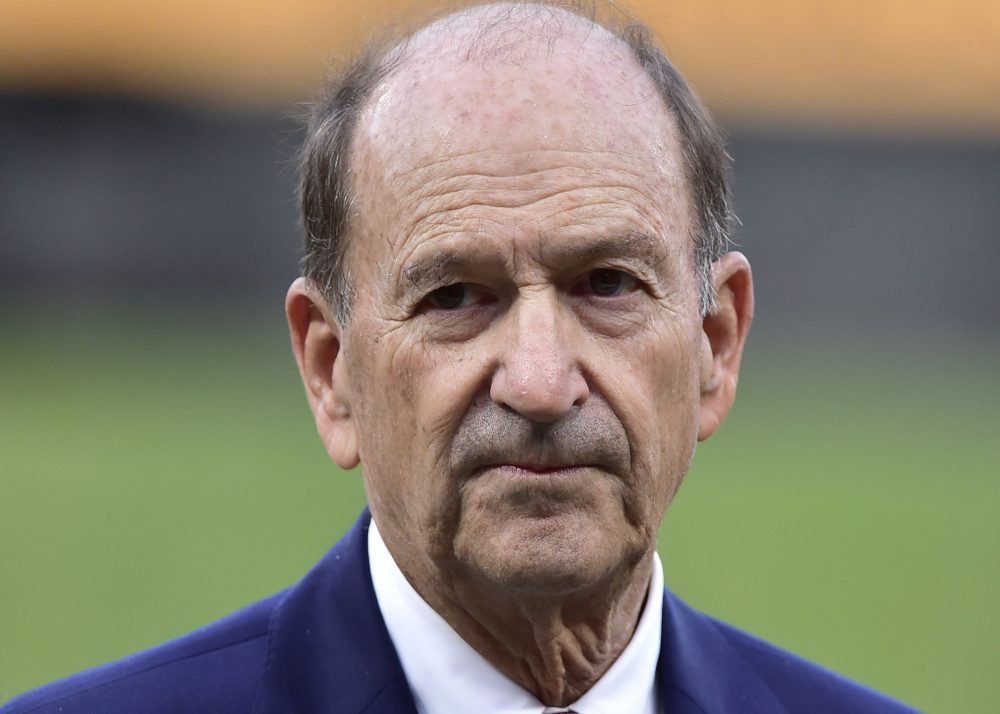

St. Louis Cardinals chairman Bill DeWitt gave a radio interview on St. Louis station 590 The Fan that is pretty remarkable. (Click here, scroll down to Bill DeWitt 6/9/20). I could write about a lot of what he said—about the potential for a 2020 season, for example, or how paying players less money didn’t increase profits (“Don’t think for a minute that the reduced payroll added money in the pockets of the owners because it didn’t”). But you don’t want to read a 2,500-word article, and I don’t want to write one. Instead, I’m going to focus on one sentence:

The industry isn’t very profitable, to be quite honest.

I’ve written about how baseball finances are oblique. That’s OK. As I’ve also written, Forbes provides authoritative estimates of the profitability of the industry. And per Forbes:

- Bill DeWitt bought the Cardinals for $150 million in 1996. That isn’t a Forbes estimate, it’s public record.

- The Cardinals, per Forbes, were worth $2.2 billion in March. That’s a compound annual growth (CAGR) rate of 11.8 percent on the $150 million investment.

- But wait, there’s more. The Cardinals, per Forbes, generated operating income (cash before interest, taxes, depreciation and amortization) of $72 million last year. That alone raises the CAGR to 12.0 percent. Did they make money in 2018? Yes. 2017? Yes. 2016? Yes. Look, this is getting monotonous. Let’s say DeWitt made a CAGR in excess of 12 percent.

As I’ve said in previous articles, I was a Wall Street financial analyst. I recommended stocks to institutional investors, like pension funds, mutual funds, and hedge funds. In order to do this, I had to be licensed. One of the licenses I had to get was as an investment advisor, which means I could talk to the public about investments.

If I were to tell somebody, “This is an investment that will give you a 12-percent-plus return over 24 years,” the best-case scenario is that I lose my license. The worst-case is that I wear orange, which is really not my color. Because here’s a pro tip, from somebody that was an actual pro: If anyone tells you about an investment that’s going to yield you 12 percent, year after year, run away. I mean, Bernie Madoff—architect of the greatest Ponzi scheme in history—said he could generate consistent returns of 10 to 12 percent. We know how that worked out.

Point being: DeWitt has been earning outsized returns, year after year after year, for 24 years. Oh, and about the $150 million he paid for the Cardinals—he got half of that back within a year, selling four parking garages received in the club’s purchase for $75 million. So take those outsized returns and double them, if you’d like.

Bill DeWitt has earned returns on his baseball investment that are far, far higher than anyone outside his financial class could reasonably expect. Why? As I’ve written, baseball team owners engage in activities that distort free markets. They have a thumb on the scale, abetted by legislators from the federal to local level. A cadre of free-market capitalists, clambering for state-supported industry.

And here’s what I find particularly galling. Bill DeWitt has a net worth estimated by Money at about $4 billion. Take away the Cardinals’ $2.2 billion, and that leaves $1.8 billion. The net $75 million he invested in the Cardinals (after the parking garage sale) is 4.2 percent of his net worth. For that 4.2 percent investment, he’s gotten on TV holding two World Series trophies, walked through the clubhouse having all the famous athletes call him “Mr. DeWitt,” and, yes, been interviewed on 590 The Fan and other outlets. He’s reaped intangible benefits that you and I could never dream of. For a 4.2 percent investment. That’s increased in value at a rate that would make Bernie Madoff blush.

I don’t begrudge Bill DeWitt his wealth. I don’t begrudge his desire to make more money. Hey, I worked on Wall Street, I get it.

But for crying out loud, be honest. The baseball industry is off-the-charts profitable. You’re a very rich man, and baseball has made you far richer. Claiming anything otherwise is frankly insulting. And I’m being, in your words, “quite honest.”

Thanks to FanGraphs’ Craig Edwards for pointing me to the sale of the garage.

Thank you for reading

This is a free article. If you enjoyed it, consider subscribing to Baseball Prospectus. Subscriptions support ongoing public baseball research and analysis in an increasingly proprietary environment.

Subscribe now

Baseball owners are hated by the Left simply because they are owners. Some are bad, some are average, some are good. They all frustrate every fan and analyst at some point. But basically they are a punching bag: they don’t behave the way that we want them to and we react. I would rank the Dodgers ownership as good, but their failure to add a proven closer and an ace-caliber starter has frustrated me (and others) for years. Everyone likely has similar stories about the clubs that they are fans of. And that’s okay, but hating on people just because they are wealthy or own a team is silly.

I knew one of America’s wealthiest men. At one point if had been a nation his GDP would have put him in the top 100. Stereotyping would portray him as a cruel and grasping miser, when in reality he was one of the kindest, most humble, and most decent people I ever knew.

Remember this about team owners and the wealthy: some are bad, some are average, and some are good - just like every other group of people in America.

So how much would it be, factoring in estimates for the above?